Personal Insurance

When everyday coverage just isn't enough, it's easy to feel left out in the rain. Welch's Insurance Agency offers a protection that goes above and beyond your auto and home insurance coverage to shield you from unexpected events. You've worked hard to build your family, home and retirement-- so adequately protect them from unexpected liability claims. With Welch's you can stay sheltered from the elements and feel secure.

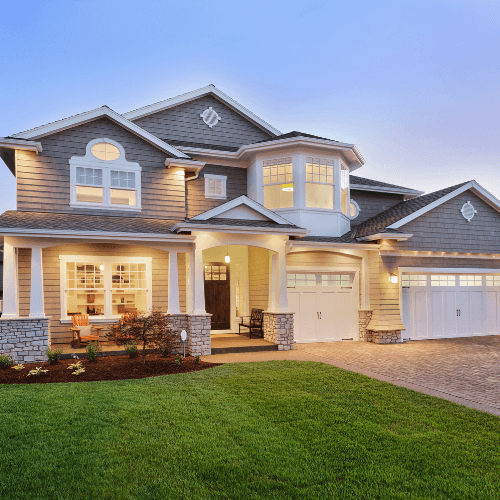

Home

Your home is one of the greatest assets in life. Whether your home is a house, townhouse, mobile home, apartment, or a personal condo, you can protect your residence and the precious belongings inside with the right insurance policy. Coverage for landlords and renters is also available.

Policies provide*:

- Coverage for the contents of your home, such as furniture, clothes, and TVs

- Damage to your property resulting from many covered causes including lightning, fire, smoke, windstorm and theft1

- Liability coverage for judgments, court fees and legal defense expenses from lawsuits resulting from injuries anyone sustains on your property

Looking for specialty coverage, for those unique exposures vulnerable within your standard home insurance policy? Our fully adaptable policies can be customized with further endorsements, which may be purchased, to enhance your homeowners insurance! Clients can benefit from additional coverage options, including:

- Valuable Articles/Floater Insurance policies (i.e. Jewelry Insurance, Guns, Computers, etc)

- Service Line Coverage

- Equipment Breakdown

- Water Backup of Sewer or Sump Pump

- Refrigerated Products Coverage

- Flood Insurance Policy

- Earthquake Coverage

- Umbrella Insurance Policy (additional liability)

- Animal Liability (liability issues due to household pets)

- Canine/Feline Protection Coverage

You’ve worked hard to secure yourself a safe and inviting place to call your own—now the next logical step is protecting you and your property from a range of risk exposures.

Auto

- Bodily Injury Liability – covers injuries to others caused by the policyholder's negligence while operating an automobile.

- Medical Payments – Protection to pay the cost of medical care to the insured and/or passengers of the auto at time of accident regardless of whether the policyholder is liable.

- Property Damage Liability – covers damages caused to someone else’s property by the policyholder while operating an automobile.

- Collision – insures the policyholder from loss during a collision with another vehicle or object other than an animal.

- Comprehensive – protection for the policyholder’s car from damage and loss resulting from incidents "other than collision" for example deer hits, hail, theft, vandalism, windshield replacement, etc.

- Uninsured/Underinsured Motorist Coverage – covers medical treatment of the policyholder’s injuries in the event of a collision with an uninsured/underinsured driver.

- Additional endorsements that may be added to an auto policy: Emergency Roadside Coverage, Rental Car Coverage, Car Damage Replacement, Loan Lease (GAP) Coverage, Trip Interruption, Excess Electronic Equipment Coverage, and Full Glass Coverage.

Umbrella

Protecting your family and assets is a top priority, which is why people have insurance. But what happens if you find yourself in a situation where your insurance is not enough? Well, that's when a personal umbrella policy could help cover you.

A Personal Umbrella Policy (PUP) is a type of insurance that provides liability coverage over and above your automobile or homeowner's policy. So, if your liability coverage isn't enough to cover the damages of an accident you cause or an incident on your property, a personal umbrella policy kicks in right where your other liability underlying limits have been reached. An umbrella policy can protect you when your automobile or homeowners insurance isn't enough.

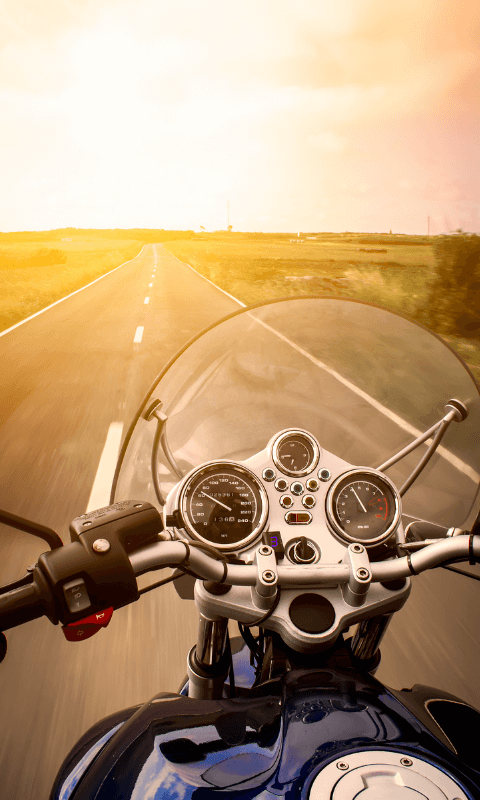

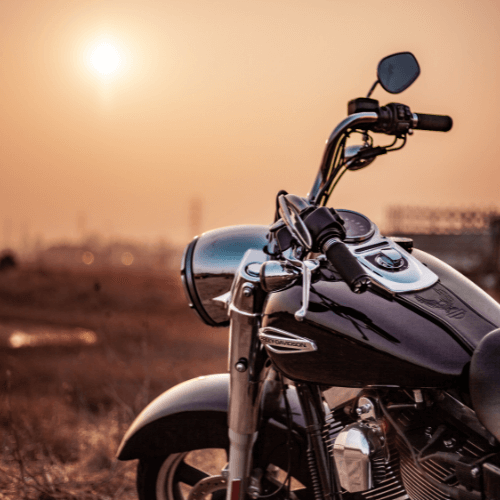

Motorcycle

We have several companies that offer coverage for your motorcycles and recreational vehicles. Most of the time we can package this together with your auto and home coverages. We also have some companies that have a specialized package just for motorcycles. Motorcycle insurance is required by law. We can customize the policy to fit your needs whether you have a standard bike or a customized bike.

Watercraft

There’s nothing quite as exhilarating as boating, wind in your hair, splashing of the water, the open air. We have several companies that offer specialized packages for your boat coverage and we may also be able to package this together with your auto and home insurance. Packages can include customization for your boat and all the accessories.

Renters

Renters insurance acts as a homeowner’s insurance policy for those who rent, and inevitably can help protect you and your assets. Having renter’s insurance can also help to mediate the cost of damages should anything happen to a rental property that you are living in. Do not make the mistake of assuming your landlord’s home insurance will cover you and your assets. A landlord’s policy covers only the physical structure of the rental property—not your belongings.

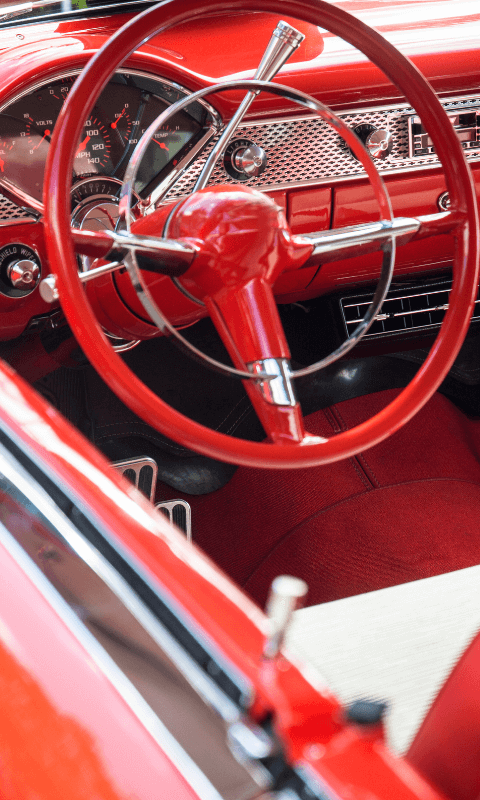

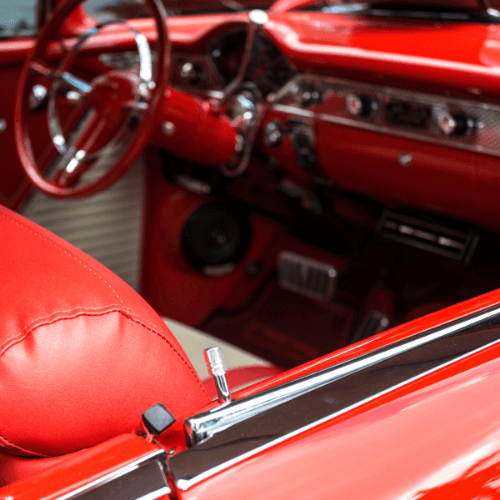

Collector Vehicles

Most vehicles depreciate in value the older they become – but there are vehicles that are restored or kept in excellent condition that appreciate in value and become your pride and joy.

Why buy classic car insurance?

You may have noticed there's a big difference between collector car insurance policies and regular use policies, including cost. Hagerty collector car insurance boasts low premiums and excellent coverage. Other benefits include:

- Agreed Value Coverage — In case of a total loss, you get the full amount of insured value on your collector car insurance policy.

- No Deductible — In most states, you pay nothing if you have a claim.

- Flexible Usage — Enjoy your classic with comfortable classic car insurance limits.

- In-House Claims — Your claim is handled by a collector car insurance expert.

- Repair Shop of Choice — Take your car to your favorite repair shop.

- Restoration Coverage — Protect your classic with classic car insurance and increase value during the active project.

Flood

Just a few inches of water from a flood can cause tens of thousands of dollars in damage. From 2008 to 2012, the average residential flood claim amounted to more than $38,000. Flood insurance is the best way to protect yourself from devastating financial loss.

Flood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters. Costs vary depending on how much insurance is purchased, what it covers and the property's flood risk.

All policy forms provide coverage for buildings and contents. However, you might want to discuss insuring personal property with your agent, since contents coverage is optional. Typically, there's a 30-day waiting period from date of purchase before your policy goes into effect.